IN TRUST

ABOUT US

We specialize in comprehensive financial services in foreign exchange, banking, payments and processing.

We are the service center for our clients who need access to top-tier banks, e-money institutions, asset managers, foreign exchange brokers, card program managers, payment gateways, global crypto-asset services and private banks. With a cumulative 50 years of industry experience, our principals understand both client needs and market dynamics. We simplify the process of identifying and structuring the perfect solution for our clients.

FINANCIAL SERVICES

We are a trusted partner for organizations and individuals around the world, providing support in a variety of business sectors and jurisdictions, enabling us to offer tailor-made solutions in sectors and geographies such as Europe, Latin and North America, the Caribbean, Asia, the Middle East and Africa.

• Exclusive Multinational Trust, integrating Fiat / Crypto solutions

• Virtual and segregated IBANs

• API Integrations

• Omnibus account access

• Competitive exchange rates

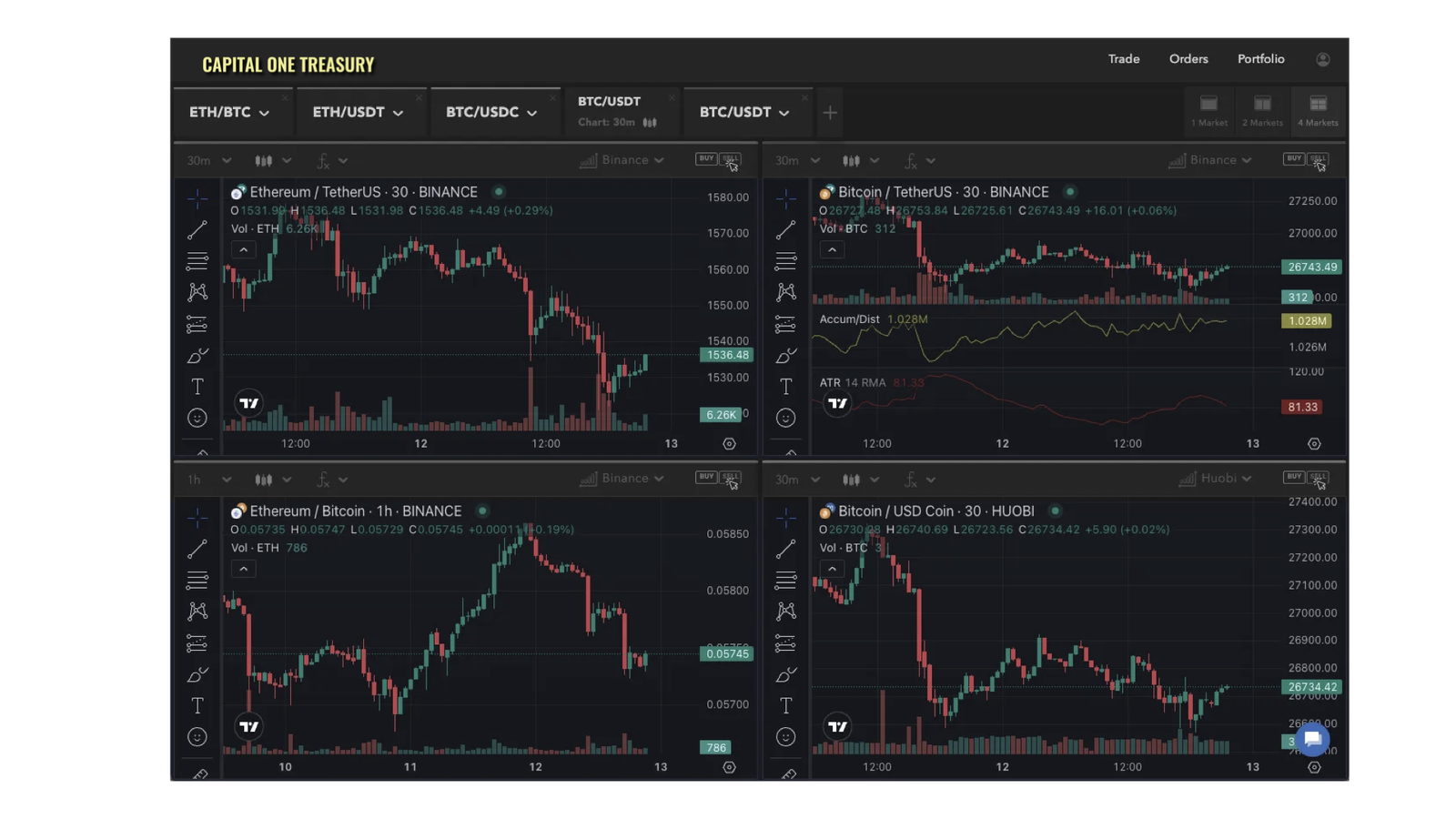

• Easy-to-use platforms & real-time reporting

• Payments to third parties

CRYPTO – OBJECTIVES

Cross-border payment services play a key role in facilitating trade and financial transactions on a global scale and are essential to our services.

These services enable individuals, businesses and institutions to transfer funds across international borders smoothly and efficiently, overcoming geographic and currency barriers.

By leveraging advanced technologies and networks, such as blockchain, SWIFT and various digital platforms, our services ensure secure, fast and cost-effective money movement while adhering to regulatory and compliance standards.

CRYPTO SERVICES

• Seamless activation and deactivation

• Compatible with all major currencies

• Wholesale liquidity

• Facilitating cross-border movements

• Multiple geographic presence

• Cryptocurrency processing

• Ability to deposit cryptocurrency-related funds in major currencies

• Support for third party payments

• Competitive fees

• Instant settlement

• Creation of our own Cryptocurrency ¨Source Treasury Gold¨ & ¨Li-Therium¨

• Crypto License in CZ – Republic

CARD PROCESSING AND ISSUANCE

We, through our partners, provide a comprehensive payment platform that offers payment card issuance and crypto wallets.

In particular, the platform offers high deposit limits, easy fund transfers, multi-currency support and supports multiple cards and bank accounts per user.

We offer a worldwide network of payment gateways and partner acquiring banks, providing customized payment processing services in all jurisdictions.

Secure credit/debit cards: Visa and MasterCard for worldwide use.

VISA / MASTERCARD

• Visa Premium Cards

• Mastercard Corporate Premium

• White-Label cards for companies such as: ¨GAME ING¨

– ¨BETS¨ in Colombia, Mexico, Brazil, Panama. (Betplay Type)

• Payment processing for companies with Webcam Service in USA, Mexico, Panama, Colombia.

• Payment processing for ¨Adult Services¨ companies.

LOANS

Payroll microcredit operations (PDL = Pay-Day Loan) (Colombia, Mexico).

FACTORING

Invoice purchase with full processing incl. Crypto (Panama, Colombia, Mexico)

REMITTANCES AND TRASFERS

National and International Remittances between: Colombia, Mexico, Panama, USA, Canada, Ecuador.

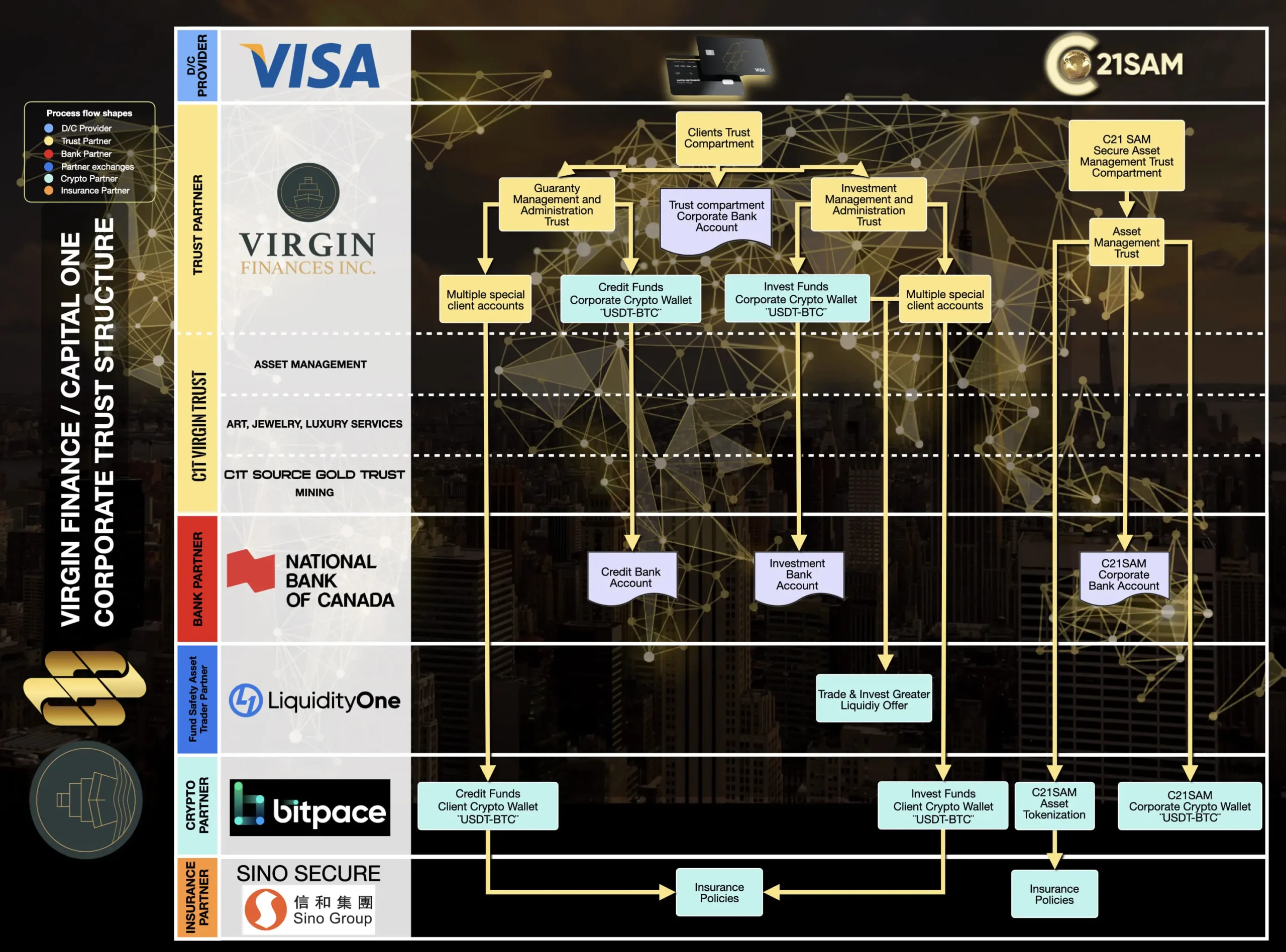

STRUCTURE

The structure to process everything physically exists through our Superpagos partners in Mexico (DF), Panama and Colombia.

• This is the integration of our new technology into the platform.

• The operations center will be expanded and headquartered in Panama City.

KYC

Authentication and Identity Verification protocol

Asset Security

Cyberattack Support & Financial Fraud Insurance

Conciliations

System for Reconciliation of Operations and accounting records of Digital Assets

Customer Support

Personalized attention 24/7, Platform & Status Support Transactional

FIAT Compensation

CIT is in charge for compensating the Ally B to ensure the fluidity of the remittance process

24/7 Availability

Platform with all-around functionality time available

PREMIUM VISA/MASTERCARD CARDS

Exclusive access by invitation only

CRYPTO / TOKEN

Digital Financial Solutions with Crypto and Blockchain

At Capital One Treasury, and through our top-tier partners, we provide specialized services for companies, investors, and individuals looking to fully leverage the opportunities of the digital financial ecosystem.

Crypto ↔ Fiat Exchange

We facilitate secure, fast, and transparent transactions between cryptocurrencies and traditional money, ensuring liquidity and professional support through our partner network.

Crypto Payments

Integrate payments in Bitcoin, Ethereum, USDT, and more, reducing costs and expanding your global reach with instant transactions backed by trusted strategic partners.

Property Tokenization

We transform real estate assets into digital tokens, enabling fractional investment, greater liquidity, and accessibility, supported by the expertise of top-tier industry partners.

Yield on Your Cryptocurrencies

If you already hold digital assets, we design private and tailored strategies to generate yield on your cryptocurrencies, in collaboration with our specialized partners.

Large-Volume Transaction Brokerage

We act as trusted intermediaries in high-volume fiat ↔ crypto operations, ensuring security, discretion, and professional support, thanks to our network of top-tier partners.

International Asset Management Services

At C21SAM, we specialize in maximizing the value of your assets through tailored investment and financial solutions. Leveraging a global network of experts, we provide comprehensive services that combine innovation, security, and international reach.

What We Offer

- Customized Investment Solutions – From real estate sourcing and market research to debt financing and asset management, our team designs strategies aligned with your goals.

- Investment Fund – Based in Luxembourg, our fund focuses on secure and profitable opportunities in luxury real estate, agricultural land, construction, and more. Accessible through our website and mobile app.

- Asset Management – Personalized solutions to meet the diverse and sophisticated needs of investors seeking efficient administration and growth.

- Asset Securitization – Transforming specific assets, such as real estate or financial claims, into financial instruments to optimize cash flow and raise capital.

Additional Services

- Real estate financing, management, and custody solutions

- Brokerage, consulting, valuations, and cross-border transactions

- Project and asset financing, securitization agreements, and digital asset management

- Full compliance and financial reporting across multiple jurisdictions

Our Impact

With over USD 1.5 billion in assets already under management and global expansion requests exceeding USD 3 billion, C21SAM continues to open doors to secure and profitable investments worldwide.